Salary Meaning For Hra

As per the salary income structure laid down by the Government of India the employer should provide HRA apart from basic salary and dearness allowance to suffice the rented housing or accommodation expenses of the employee. What is House Rent Allowance or HRA.

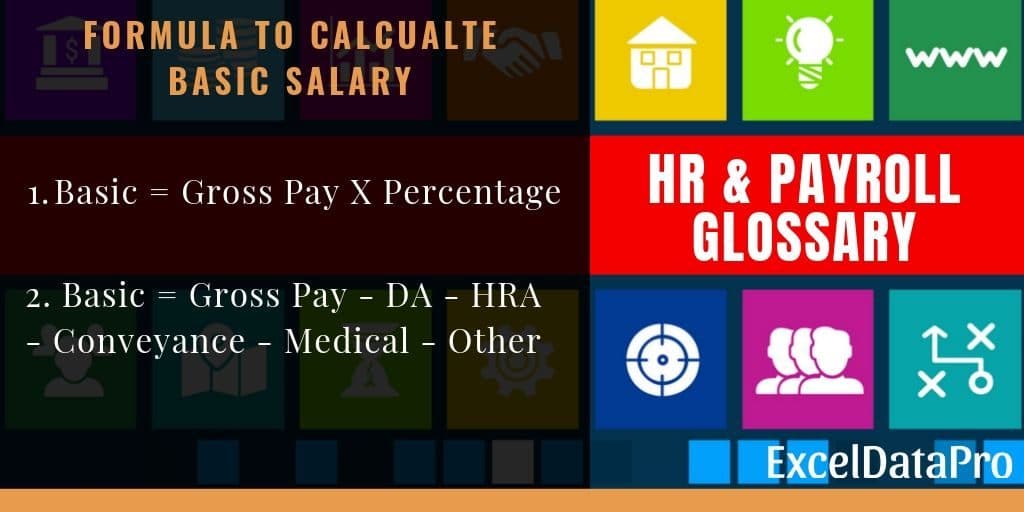

Salary Formula Calculate Salary Calculator Excel Template

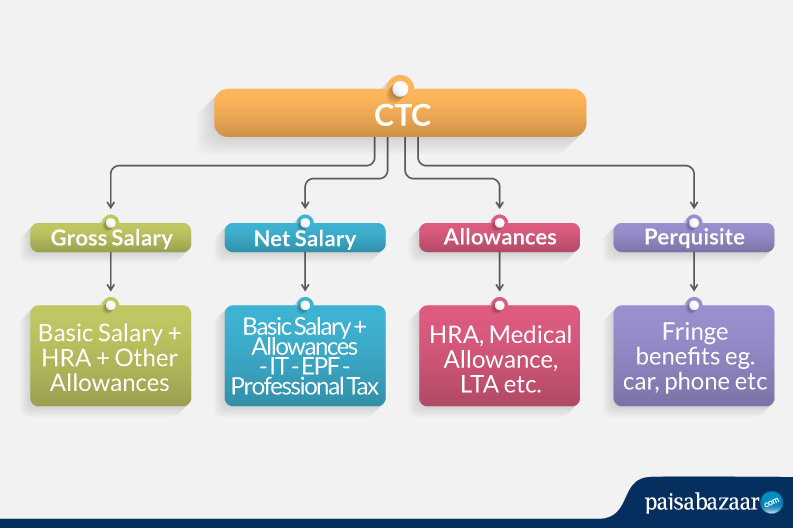

Usually the Gross salary components encompassed with the following sections.

Salary meaning for hra. For the calculation of gratuity salary includes only. 286 popular meanings of HRA abbreviation. Meaning of Salary for calculation the exemption of HRA.

INR 800- Can avail Tax exemption till 800 SPL. HRA is a key component of the salary and is taxable under the Income Tax Act. However Income Tax Act provides a deduction of hra under section 10 13A subject to certain limits.

Usually employers keep the HRA amount at 50 of Basic Salary. HRA is a useful allocation of your salary component to save tax. For claiming benefits of HRA exemption following conditions must be satisfied.

7 lignes The full form of HRA is House Rent Allowance which often forms a key taxable component of a. Salary is to be taken on due basis in respect of the period during which the period accommodation is occupied by the employee in the previous year. It is an allowance paid by your employer for your house rent expenses which is eligible for a tax benefit under Section 10 13A of Income Tax Act 1961.

What is HRA. Flexible Hours Working 8 hours a day but without a strict timetable. HRA comes under Section 10 of Income Tax Act 1961 and the exemption can be claimed partially or fully.

As per section 10 of Income Tax Act 1961 Amount of HRA is not included in the total income of a person which results in reduced tax liability. Salary structure is the detailed break-up of the various components of monthly salary that is offered as compensation to an employee. I want to know if i have a Salary BasicHRAAllowances more than 15ooo how much will be my EPF contribution whether it will be 12 of Salary or 12 of 150000.

Employees dont always need to be at the office. Such allowance is taxable in the hand of the employee. Gratuity can also be calculated.

Allowing your employees to work from home from time to time is no cost to. This is approximately 40 of the Cost-To-Company CTC and it is taxable. Examples for calculation of exemptiondeduction of HRA.

Flexible hours are especially attractive to employees with children or caregivers of other people or even pets. Full Form of HRA and meaning Full form of HRA is House Rent Allowance. The essential components of salary include.

House Rent Allowance or HRA is a salary component paid to employees by an employer towards the accommodation cost of living in that city. Even though it is a part of your salary unlike your basic pay HRA isnt entirely taxable subject to conditions a percentage of HRA is exempted under Section 10 13A of the IT Act 1961. Again in this case too DA need to be considered if it is forming part of retirement benefit otherwise not to consider and Commission also need to of turnover.

Meaning of salary for the purpose of computing HRA Exemption Salary means Basic DA Commission based on fixed percentage on turnover. Instead of 15000 salary is taken for calculation do i have a limitation to contribute only 1800 per month 12 of 15000. House Rent Allowance or HRA is a part of the salary provided by an employer to his employee for his rented accommodation.

For Nov 18 May 19 and Nov 19. Example for calculation of exemptiondeduction of HRA. Basically i am querious that even if i have the ability to contribute more than 12 of 15000 ie.

Leave Travel. It can also be calculated manually. Emotional Salary Examples.

House Rent Allowance is another major component of the salary which varies from 40-50 of basic salary. 40 of BASIC DA MEDICAL. House Rent Allowance HRA As the name suggests HRA is a specific allowance that is granted by the employer to employee to meet the expenses incurred on rent.

35 of the Gross DA. INR 1250- Can avail Tax exemption till 1250 CONVEYANCE. Salary is to be taken on due basis in respect of the period during which the period accommodation is occupied by the employee in the previous year.

5 of Gross HRA. House Rent Allowance HRA is a component of a taxpayers salary that reduces hisher tax liability provided heshe stays in rented accommodation. HRA exemption can be claimed only if the employee is residing in a rented house.

House Rent Allowance HRA is a component of Income under the head Salary provided by the employer to its employees for rented accommodation. Whats important is that employees do their job correctly. Salary Definition for Calculation of GratuityHRA EPF Leave Encashment Calculation of gratuity covered under the payment of gratuity act.

It is possible to calculate the amount of HRA that will be exempt from tax using online HRA Exemption Calculators. 2 Salary definition for House Rent Allowance HRA-For calculation of House Rent Allowance HRA you need to consider Basic Salary Dearness AllowanceDA and Commission if paid as of turnover. It comes under Section 10 and the exemption from tax can be claimed partially or fully.

House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent. Calculation of gratuity not covered under the payment of gratuity act. HRA All Acronyms viewed May 30 2021.

HRA taxable and HRA Exempted can be calculated by using the latest HRA calculator. What does HRA mean as an abbreviation. Salary means Basic DA Commission based on fixed percentage on turnover.

Hra Calculation House Rent Allowance Taxability Calculation Hra Exemption

Hra Calculator 2019 20 In Depth Guide Including Hra Agrement Format Moneyjigyasu

If You Study Theory Which Are Explained In

House Rent Allowance Exemption Excel Calculation

House Rent Allowance Hra Exemption Rules Tax Deductions Tax2win

If You Study Theory Which Are Explained In

House Rent Allowance Hra Exemption Rules Tax Deductions Tax2win

If You Study Theory Which Are Explained In

While Calculating For Hra Exemption What Is The Logic Behind Rent Paid Less 10 Of The Basic Salary Quora

House Rent Allowance Hra Exemption Rules Tax Deductions Tax Deductions Deduction Income Tax

House Rent Allowance Hra Calculation Exemption Rules Allowance Rent Taxact

Pin By Tax4 Wealth On Salary Class Home Loans Rent Allowance

Hra Calculator Exemption How To Calculate Simple Tax India

House Rent Allowance And Rent Free Accommodation Are They Really Different Tax2win Blog

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Hra Calculator Exemption How To Calculate Simple Tax India

Salary Structure Components How To Calculate Take Home Salary

Youtube Income Tax Allowance Rent

Post a Comment for "Salary Meaning For Hra"