Estimated Annual Gross Income Meaning

Means with respect to the Monthly Collection Period ending immediately prior to any Payment Date as calculated on the Accounting Date immediately preceding such Payment Date an amount equal to the product of a the quotient of i the aggregate amount of Gross Sales with respect to each Franchise Drive-In for which the Servicer has received a Monthly PL. Gross income for individuals.

How To Calculate Rental Income The Right Way Smartmove

Measom mentions that annual gross income is a persons yearly salary before deductions are made.

Estimated annual gross income meaning. If you used the Non-Filers. Annual income hourly wage hours per week weeks per year. Define Estimated Gross Sales.

But will not include any deductions from section 80C to 80U. It does not include costs and expenses. The formula for the annual income is.

Often your gross income is what you will see on the top line of your pay stub. If youre still confused about how to find annual income have a look at the examples. According to the Internal Revenue Service IRS gross income is defined as all income an individual receives in the form of money goods property and services that isnt tax exempt.

How often a person gets paid and the amount determines annual gross income. Annual income can be expressed as a gross figure or a net figure. Your annual revenue is the amount of money your company earns from sales over a year.

In simple terms Gross Total Income is the aggregate of all your taxable receipts in the previous year. 7500000 - 300000 7200000. It is opposed to net income defined as the gross income minus taxes and other deductions eg mandatory pension contributions.

Gross Pay or Salary. Your gross income or pay is usually not the same as your net pay especially if you must pay for taxes and other benefits such as health insurance. How to calculate annual income from hourly First determine your hourly pay rate and working time.

Special Instructions to Validate Your 2020 Electronic Tax Return. Revenue from goods sold - Cost of goods sold Business gross income. The gross sales formula is calculated by totaling all sale invoices or related.

Business gross income is a companys total income from all sources before subtracting taxes and other expenses. By contrast an employee who is paid 25 per hour is paid 2000 every two weeks only if they actually work 8 hours per day 5 days per week 25 x 8 x 5 x 2. Gross annual income is a number you may need often in your life to help manage your finances and plan for the future.

Some people refer to this calculation as a unit rate conversion. There are a few simple formulas you can use to figure out your own gross annual income whenever you need it. So if a companys revenue is 7500000 and the cost of goods sold is 300000 the gross income of the company is.

Enter Payment Info Here tool in 2020 to register for an Economic Impact Payment in 2020 enter 1 as your prior year AGI. If your 2019 tax return has not yet been processed enter 0 zero dollars for your prior year adjusted gross income AGI. Gross annual income is the sum of all income received from different sources during the calendar year that means from January 1 to December 31.

Avoid using the Net Pay portion of the paycheck because this includes deductions from taxes and medical insurance. How to calculate annual income. Gross Annual Income is The total amount of income earned expressed as an annual figure versus hourly or bi-weekly before taxes.

For households and individuals gross income is the sum of all wages salaries profits interest payments rents and other forms of earnings before any deductions or taxes. In this article we discuss what annual gross income is and how you can calculate it based on your own circumstances. Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary.

Gross sales is a metric for the total sales of a company unadjusted for the costs related to generating those sales. Annual income is defined as the annual salary before taxes an individual earns on a yearly basis. Companies consider gross income an important measure in their profit analysis and financial performance study.

The individuals gross income every two weeks would be 1923 or 50000 divided by 26 pay periods. From a wage earners perspective gross income is money earned before things like taxes or other deductions are taken out. For more information see Claiming the Recovery Rebate.

Gross income is a significant figure because its the foundation for many other financial calculations that give insight into a companys financial health. Also it is a measure employed by banks and other financial institutions to assess an individuals ability to pay for his. If you run a business its vital to know how to calculate and use gross income.

If you want to do it without the yearly salary income calculator substitute your numbers into this formula. It will also include profit or loss carried forward from past years and any income after clubbing provisions. This amount must be figured to calculate annual taxes to be paid.

Sales Revenue Formula Calculate Grow Total Revenue

How Is A Company S Total Annual Revenue Calculated Quora

Taxable Income Formula Examples How To Calculate Taxable Income

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Taxable Income Formula Examples How To Calculate Taxable Income

Gross Annual Income Calculator

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Annual Income Learn How To Calculate Total Annual Income

Gross Income Definition Formula Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_National_Income_GNI_May_2020-01-53d357d45bae47f29d3c72a98f190f8d.jpg)

Gross National Income Gni Definition

What Is Gross Vs Net Income Definitions And How To Calculate Mbo Partners

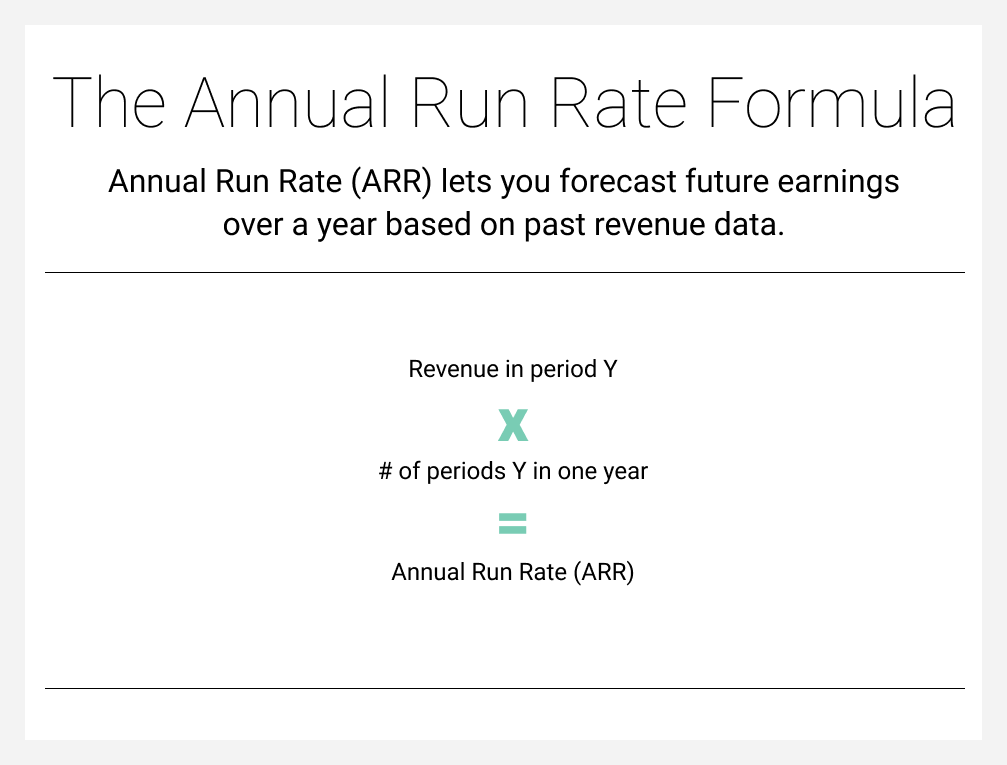

What Is Revenue Run Rate Formula How To Calculate

How Do Earnings And Revenue Differ

What Is Gross Income For A Business

Gross Income Definition How To Calculate Examples

4 Ways To Calculate Annual Salary Wikihow

Gross Income Formula Step By Step Calculations

How To Calculate Net Income 12 Steps With Pictures Wikihow

/money-and-graph-954922482-ef6824e995014ec3a75f865385696dce.jpg)

Gross Income Definition Formula Examples

Post a Comment for "Estimated Annual Gross Income Meaning"