Does Annual Income Mean Gross Or Net

On a credit application youll use the gross figure. For instance if an employee is paid an annual salary of 23000 per year but is eligible.

What Is Base Salary Definition And Ways To Determine It Snov Io

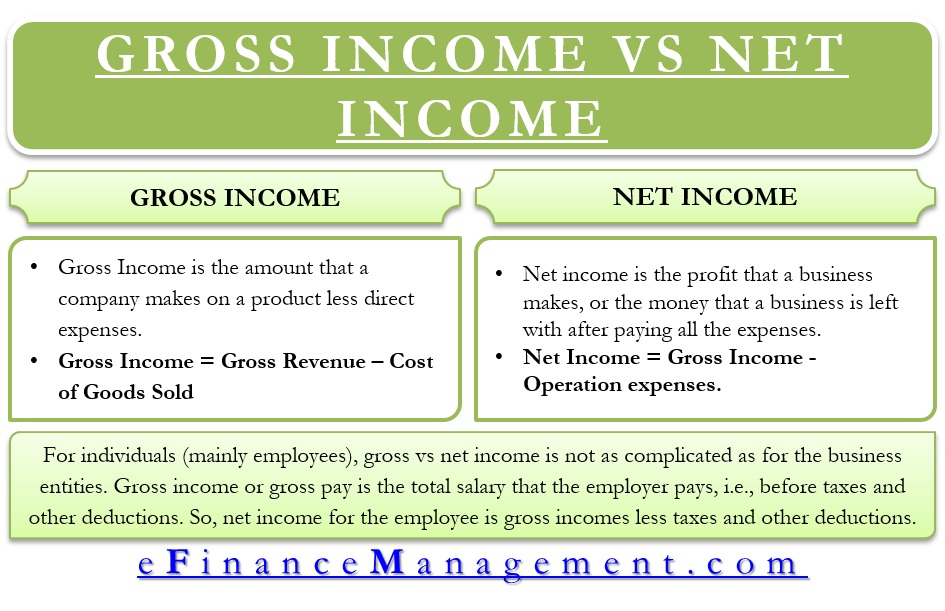

Essentially net income is your gross income minus taxes and other paycheck deductions.

Does annual income mean gross or net. Net income is what youre left with after those deductions. The easiest way to calculate your applicants net income is to use the automated income verification report from The Closing Docs. Gross means before taxes and net means after deducting taxes.

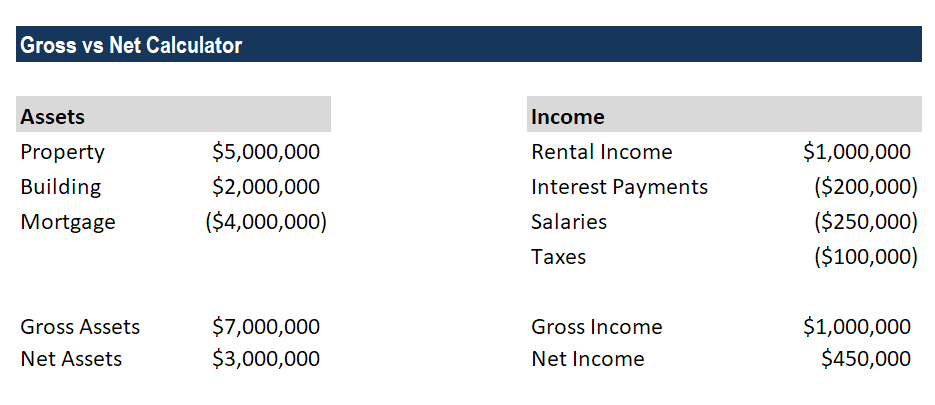

Annual gross income is your income before anything is deducted. Gross Income minus business expenses and deductions will be considered. Gross income refers to the total amount of income you or a business receives in a given year before deductions and withholding whereas net income is the amount of income left over after all other expenses are factored in.

Unless the application specifies otherwise this is usually what the issuer is looking for. Gross annual income is your earnings before tax while net annual income is the amount youre left with after deductions. Your gross annual income and gross monthly income will always be larger than your net income.

Credit card companies usually prefer to ask for net income because that is what you have available with which to pay your monthly payment. Your annual net income can also be found listed at the bottom of your paycheck. It should be gross wages because if a coworker and I have the same gross wages but different net wages because the company takes out child support or insurance or retirement or any other deductible that only one of us has we have a different number of dependents or one of us has additional income because of a working spouse or second job then our net pay will be different.

The report calculates an applicants annual net income monthly net income and includes any one-time deposits like bonuses or commission-based salaries for the past year automatically. Your gross income minus taxes and other expenses like a 401 k contribution. Taxable income starts with gross income then certain allowable deductions are.

Gross income is the amount before taxes and any additional withdrawals. To sum up - gross annual income is the amount of money your employer spent on you in a year. Your gross income is the total amount of money you receive annually.

For example the annual pay for a 10-an-hour job that you work full time 40 hours per week would be 20800. Revenue is the total amount of income generated by the sale of goods or services related to the companys primary operations. This is how much you take home after everything is deducted from your paycheck.

If the requirements are not met a co-sponsor will be required. This topic is important if youre a wage earner or a business owner particularly when it comes to filing your taxes and applying for loans. Gross income is all income from all sources that isnt specifically tax-exempt under the Internal Revenue Code.

Your gross annual income will always be larger than your net income because it does not include any deductions. You can determine your annual net income after subtracting certain expenses from your gross income. While the annual salary represents a floor for an employees wages gross pay can exceed that level.

Some companies may ask for annual gross income. Is bankruptcy eligibility including the means test determined by gross income or net income. This is a confusing and complicated part of bankruptcy law.

What Qualifies as Income. The annual net income is. In other words what you end up taking home in your paycheck multiplied by the number of times youre paid each year.

Annual net income is the amount of money you earn in a year after certain deductions have been removed from your gross income. Consider consulting with an immigration attorney for case-specific advice. Some deductions are mandatory and others are voluntary choices you have made about savings or benefits.

The reason your gross pay is always higher than your net pay is due to some mandatory and voluntary deductions from your employer and potentially due to choices you have made about savings or benefits. It is the sum of your monthly gross pay. Since net income deducts all of your expenses this net profit is almost always a smaller amount than your gross income.

Its what you take home on pay day. What you receive in your bank account is net income. If you were a salaried employee it would be gross income.

Most ask for it to be expressed in annual terms so if your gross monthly pay is. Revenue also known as gross sales is often referred to as the top. To calculate it begin with your gross income or the amount you earn from all taxable wages tips and any income you make from investments like interest and dividends.

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Salary Vs Net Salary Top 6 Differences With Infographics

Gross Vs Net Learn The Difference Between Gross Vs Net

Annual Income Learn How To Calculate Total Annual Income

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Operating Income Vs Gross Profit

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Is Net Income Definition Formula And How To Calculate

Gross Annual Income Calculator

The Difference Between Gross And Net Pay Economics Help

How Do Earnings And Revenue Differ

Gross Vs Net Differences Between Net Vs Gross You Must Know 7esl

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Gross Vs Net Learn The Difference Between Gross Vs Net

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

Gross Profit Vs Net Income What S The Difference

What Is Gross Vs Net Income Definitions And How To Calculate Mbo Partners

How To Calculate Net Income Formula And Examples Bench Accounting

Difference Between Gross Income Vs Net Income Definitions Importance

Post a Comment for "Does Annual Income Mean Gross Or Net"