What Does Annual Income Mean Before Taxes

Annual means yearly and income means profit the money earned or received. Divide the result by 12 to find your average household income.

Ebit Vs Operating Income What S The Difference

That individuals taxable income is 50000 with an effective tax rate of 1388 giving an income tax payment 693950 and NI of 4306050.

What does annual income mean before taxes. Thats your annual salary. Salary after those tax payments is known as an employees net salary. Your annual net income can also be found listed at the bottom of your paycheck.

The concept applies to both individuals and businesses in preparing annual tax returns. Therefore annual income means the amount of money obtained during a year. An individual or companys income before taxes and deductions.

In a company it is calculated as revenues minus expenses. What do the parts of annual net income mean. Gross annual income is the sum of all income received from different sources during the calendar year that means from January 1 to December 31.

Gather up any information like paycheck stubs or bank accounts and add the amount to obtain your annual household income. Your annual household income is simply all the income for all the people living in the household over the course of a year. This amount must be figured to calculate annual taxes to be paid.

You would usually provide your gross income for reporting your annual income unless net income information is specified. An employee who earns an annual salary is basically guaranteed to be paid a set amount of money each year. Annual net income is the amount of money you make in a year after all deductions and taxes are subtracted out.

Difference Between Gross and Net. Your gross income contains the income you generate throughout the entire year before you pay taxes and take deductions on that income. Gross salary represents the amount of wages paid to an employee prior to reductions for prepaid income taxes Federal Insurance Contributions Act FICA taxes Medicare taxes and a variety of state and local taxes.

Gross annual income refers to all earnings before any deductions are made and net annual income refers to the amount that remains after all deductions are made. Thats your monthly income before taxes. Much of the discussion has centered on the fact that real adjusted for inflation median household income has fallen since 1999.

Annual income can be expressed as a gross figure or a net figure. Annual net income is the amount of money you earn in a year after certain deductions have been removed from your gross income. Annual household income is the amount of money taken in by all members of the household combined from any of the listed sources listed.

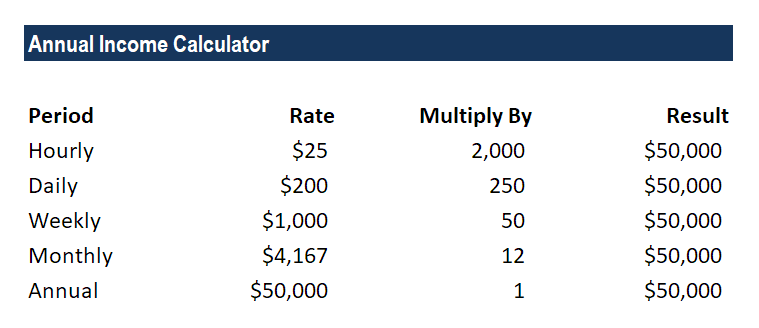

Since annual means year if you are a salaried employee this is your salary for a year. Enter your hourly pay and multiply it by the number of hours you work during the week. Reporting Income to the Federal Government You report your income to the federal government when you file taxes each year.

For individual income it is calculated as the individuals wages or salary investment and asset appreciation and the amount made from any other source of income. Salary can be supplemented but it is essentially a. Gross annual household income is the amount before any deductions are taken.

Many suggest that this is a sign the economy is not lifting all boats. It comprises all incomes. NI on Tax Returns.

After-tax income is gross income minus deductions of federal state and withholding taxes. Gross income is your annual income before taxes and deductions. You can determine your annual net income after subtracting certain expenses from your gross income.

If you work by the hour you can figure out how with a calculator how much you earn in a year. Now what is net annual income and gross annual income. The definition of annual is yearly On a credit card application you report the amount of income you receive on a.

If you divide that by 12 months in one year you get 541667 per month. After-tax income is the disposable income that a consumer or firm has available to spend. For example lets assume an individual makes an annual salary of 50000 and is taxed at a rate of 12.

If your pay stub says your earnings before deductions for that two-week period are 2500 you can multiply that by 26 to get 65000. New income data released by the Census Bureau on Tuesday has been the topic of considerable news coverage for the past few days. To calculate the after-tax income simply subtract total taxes from the gross income Gross Income Gross income refers to the total income earned by an individual on a paycheck before taxes and other deductions.

Annual Income Learn How To Calculate Total Annual Income

Some Nonpayers Do Pay Income Tax Income Tax Income Tax

How Do Operating Income And Revenue Differ

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Everything You Need To Know About Self Employment Taxes Small Business Tax Self Employment Bookkeeping Business

Form 1040 U S Individual Tax Return In 2021 Irs Tax Forms Tax Forms Tax Return

Negative Income Tax Is A Tax System In Which Low Income Workers Are Eligible For Supplemental Pay From The Government Rather Than Income Tax Income Negativity

You Work Hard For Your Money Davidson County Offers Free Tax Prep For Families Whose Annual Income Is Less Than 65 000 Plea Tax Prep State Tax Filing Taxes

What To Do When You Owe Back Taxes Infographic Business Tax Deductions Business Tax Money Management Advice

Gross And Net Income Personal Financial Literacy Financial Literacy Anchor Chart Personal Financial Literacy Anchor Chart

Why Are Timeshares So Bad In 2021 Timeshare Beach Vacation Kids Kids Vacation

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Success Business

Differences Between Ebit And Profit Before Taxes Cost Of Goods Sold Cost Of Goods Sales Revenue

Explore Our Image Of Annual Income Statement Template For Free Statement Template Income Statement Cash Flow Statement

Pin On Small Business Tax Tips

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under The C Capital Gains Tax Capital Gain Paying Taxes

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "What Does Annual Income Mean Before Taxes"