Target Payout Ratio Formula

The dividend policy sets a target payout ratio of at least 25 of X5s net profit provided that the companys net debt-to-EBITDA ratio is below 20x 2017. This ratio indicates the extent to which the claims of short-term creditors are covered by assets expected to be converted to cash in the near future.

Leverage Ratio Formula Calculator Excel Template

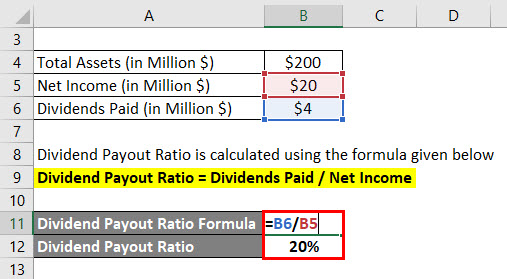

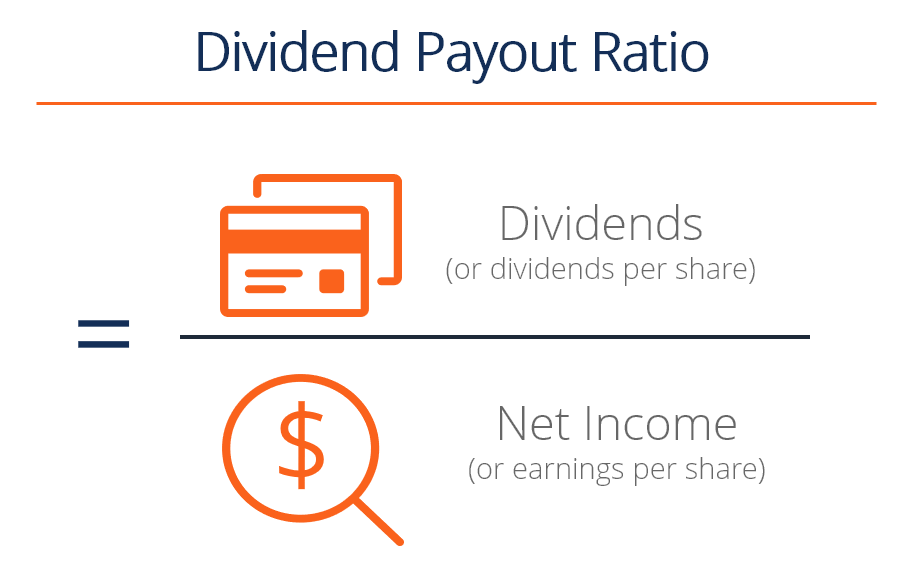

The payout ratio formula is expressed as total dividends divided by the net income during the period.

/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)

Target payout ratio formula. Sometimes the payout ratio is equal to the target payout ratio. You could calculate a companys payout ratio for a particular quarter for example. The general formula for payout ratio is quite simple.

A mid-50 payout ratio signals positive intent from the company to declare dividend payouts and also retain to grow. Target payout ratios vary by industry. There are several formulas for calculating DPR.

So to do that companies can do the following measures. Mathematically it is represented as Payout Ratio Total Dividends Net Income The payout ratio formula can also be expressed as dividends per share divided by earnings per share EPS. A payout ratio that is between 75 to 95 is considered very high.

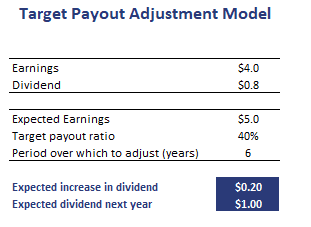

Days sales in inventory ratio. DPR Total dividends Net income 2. Target Payout Adjustment Model Formula.

Telecommunications provider Telus Corp. Expected Dividend Py Dividend Expected earnings X Target Payout Ratio- Py Dividend X Adjustment Factor. You can use any time period to calculate a payout ratio.

It is calculated by dividing the dividends distributed by the net income for. Current assets divided by current liabilities. December 21 2015 Expected Dividend Previous Dividend Expected Increase in EPSTarget Payout RatioAdjustment Factor Adjustment factor is one over the number of years of planned dividend increases.

How to Calculate the dividend payout ratio. 2021 is calculated as. Finally calculate the payout ratio.

Targets Dividend Payout Ratio for the fiscal year that ended in Jan. Next enter B1B2 into cell B3. Some companies set a target range for their payout ratios.

Sustainable growth rate formula as discussed above assumes that a company wants to increase its sales and revenue by maintaining its target capital structure along with a stable dividend payout ratio. Other times the payout ratiowhich is dividends per share divided by earnings per sharemay. The payout ratio is 1111.

Take the companys dividends per share divide them by earnings per share and multiply the result by 100 to convert it to a percentage. For example aims to pay out 65 to 75 per cent of sustainable earnings. The formula for Target Payout Ratio Adjustment Model given in Core is as follows.

Payout Ratio Total Dividends Paid Net. 2021 is calculated as Targets Dividend Payout Ratio for the quarter that ended in Apr. Enter Payout Ratio into cell A3.

This increases the risk of the company cutting its dividends because our formula is forward looking. Target Dividend Payout Ratio Calculation Dividend payout ratio measures the percentage of the companys earnings paid out as dividends. It implies that the company is bordering towards declaring almost all the money it makes as dividends.

Whereas in the notes the formula given for Lintner Model is Expected Dividend Py Dividend Delta Earnings X Target Payout Ratio X Adjustment Factor. Heres the formula financial specialists use to calculate payout ratios which determines the dividend payouts companies make to their shareholders. Target payout adjustment formula Lets start by discussing the formula that can be used to forecast the expected increase in the dividends if the company follows a target payout adjustment method.

The Target Payout Ratio or Dividend Payout Ratio is the fraction of net income a firm pays to its stockholders in dividends. A range of payout ratios that is typical based on an analysis of comparable firms. A target of 50 to 60 is right in the sweet spot for dividend investors looking for companies that have a good mix of earnings retention and dividend payouts.

The formula looks as follows where the adjustment factor is equal to 1number of years over which the adjustment will take place.

:max_bytes(150000):strip_icc()/ForwardPEExcel4-4164d10acc6f496cb72e9a29309ec818.jpg)

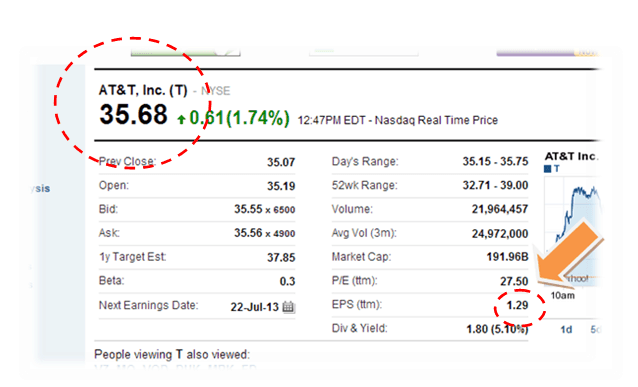

How To Calculate A Company S Forward P E In Excel

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Pe Ratio Formula Understanding Why It S Such A Popular Stock Metric

Reserve Ratio Formula Calculator Example With Excel Template

Internal Growth Rate Formula Calculator Excel Template

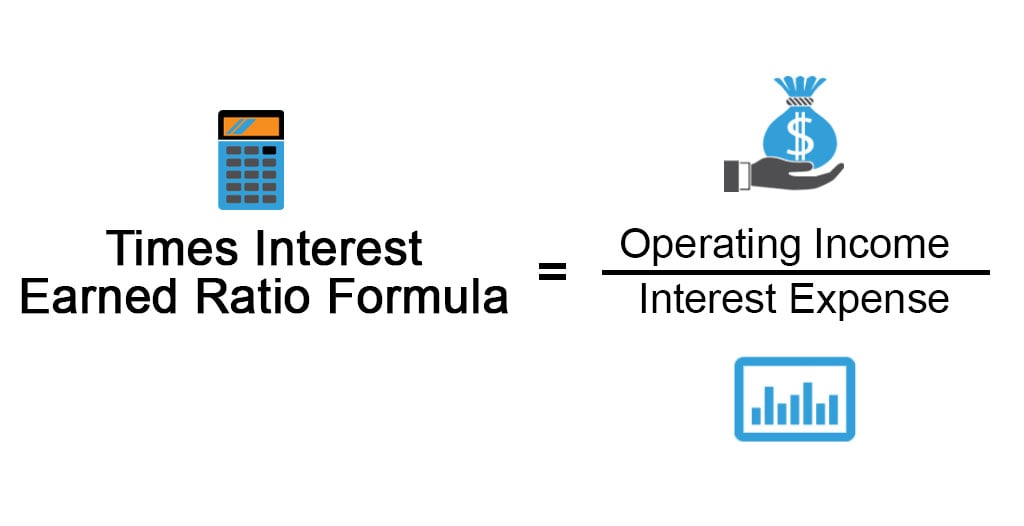

Times Interest Earned Ratio Formula Examples With Excel Template

Download Ratio Analysis Excel Template Exceldatapro Excel Templates Financial Analysis Financial Ratio

Sustainable Growth Rate Formula Calculator Excel Template

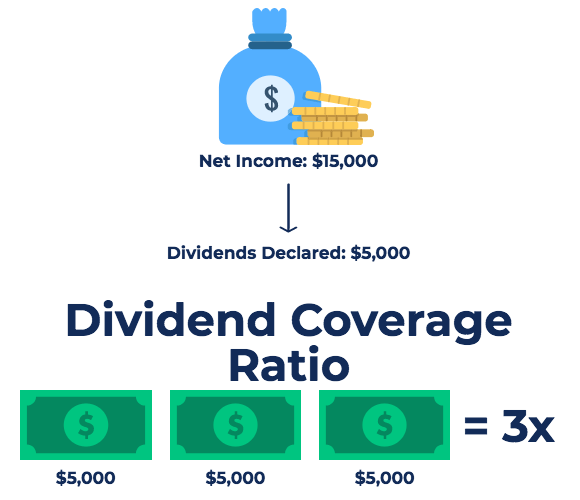

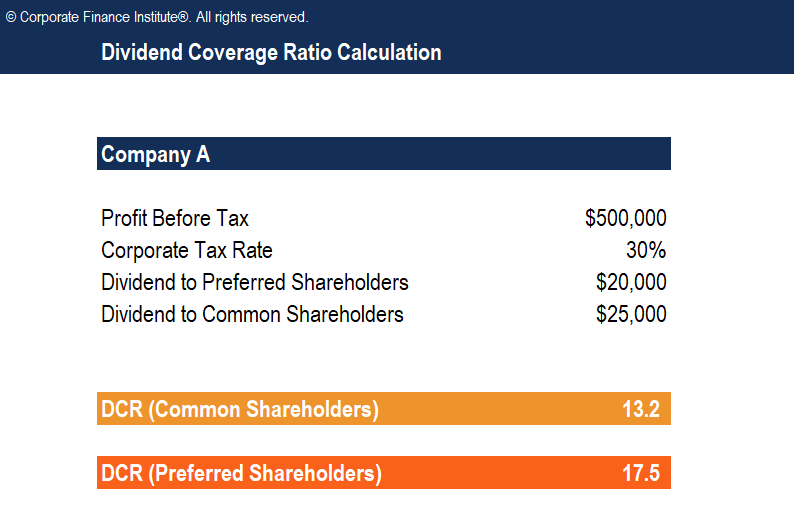

Dividend Coverage Ratio Formula Examples And Guide To Dcr

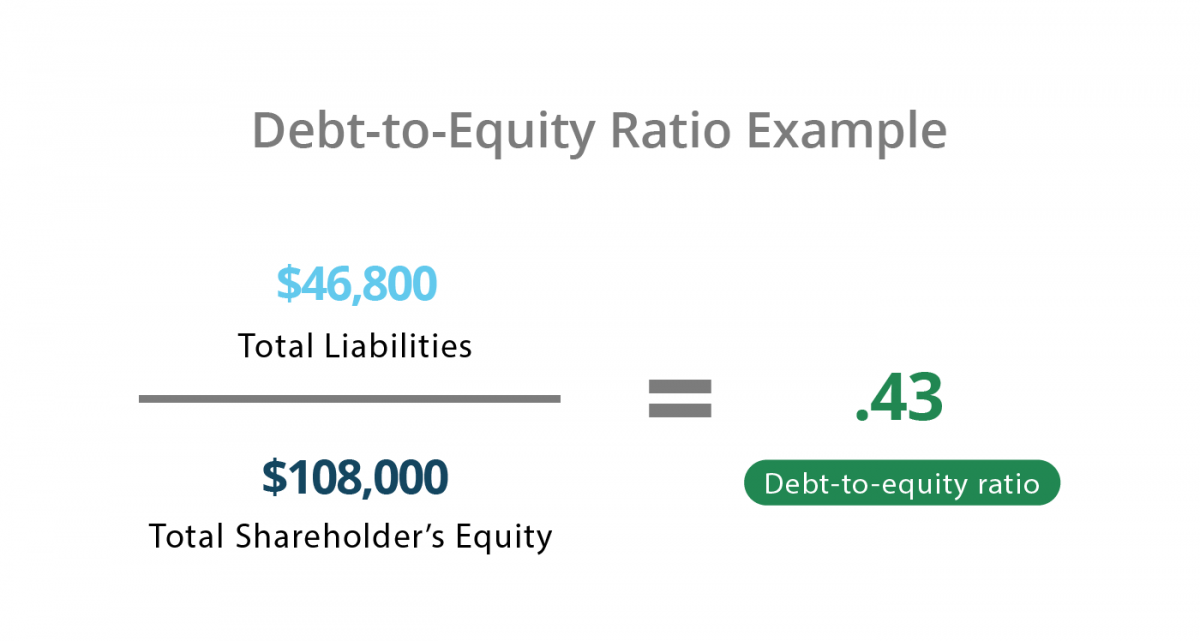

Debt To Equity Ratio How To Calculate Leverage Formula Examples

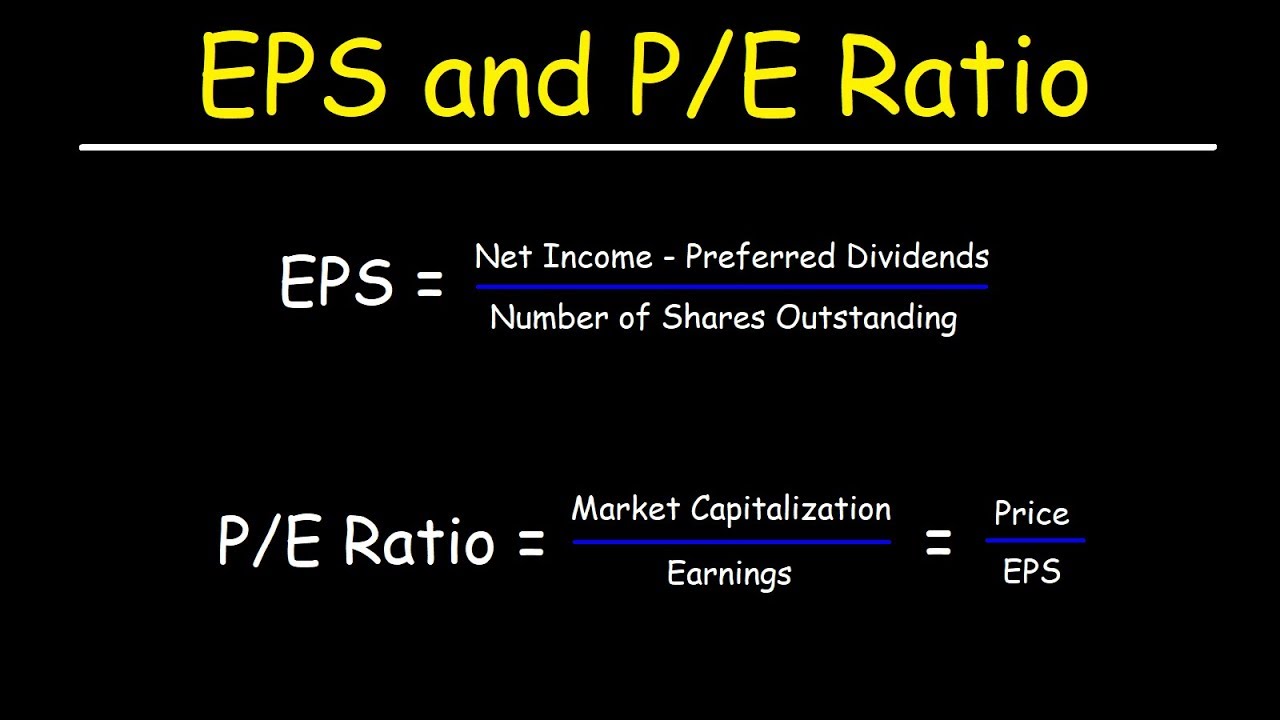

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

Internal Growth Rate Formula Calculator Excel Template

Target Payout Adjustment Model Breaking Down Finance

Dividend Coverage Ratio Formula Examples And Guide To Dcr

What Is Dividend Yield Definition Formula Usefulness For Investors

Contribution Margin Ratio Formula Per Unit Example Calculation

Debt To Equity Ratio D E Ratio Investinganswers

Dividend Payout Ratio Formula Guide What You Need To Know

Post a Comment for "Target Payout Ratio Formula"