Monthly Income Tax Calculator Uk

Calculator - UK Salary Tax Calculator 40000 Salary Take Home Pay If you earn 40000 a year then after your taxes and national insurance you will take home 30840 a year or 2570 per month as a net salary. Rental income tax calculator TaxScouts.

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Your taxable rental income will be.

Monthly income tax calculator uk. Unlike our salary calculator where your salary calculation results are updated in one shot here you just need to enter or slide the top gross income stick and immediately you will see the total tax national. The calculator is updated for the UK 2021 tax year which covers the 1 st April 2021 to the 31 st March 2022. The salary can vary based on the qualifications location and experience of the individual and the annual compensation is usually between the ranges of 20000.

The Monthly Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more. You can claim 3600 as other rental expenses. Updated for 20212022 accurately calculating HMRC Income Tax salary PAYE National Insurance student loan repayment and pension contibutions.

852 in rental income tax. 11 income tax and related need-to-knows. To use the tax calculator enter your annual salary or the one you would like in the salary box above.

You can switch between Income Tax Calculator Monthly Income Tax Calculator and Weekly Income Tax Calculator modes. The average salary for a qualified chartered accountant in the UK is 31593Out of this gross income an accountant will take home 25123 per year or a net wage of 2094 per month once tax and National Insurance is deducted. Tax-free childcare Take home over 500mth.

This is the most advanced income tax calculator providing a visual breakdown of how your salary is broken up for tax and other deduction purposes. Income tax calculator - Salary calculator - Tax calculator - Average salary UK - Take home pay calculator - Pro rata salary calculator - Net salary calculator - PAYE tax calculator - 20000 after tax - 25000 after tax - 30000 after tax. The latest budget information from April 2021 is used to show you exactly what you need to know.

12270 will be taxed at 20. Note that your personal allowance decreases by 1 for every 2 you earn over 100000. Uniform tax rebate Up to 2000yr free per child to help with childcare costs.

This calculator has pre-programmed tax rates and allowances for the different tax rules for United Kingdom countries - England Scotland Wales and Northern Ireland. Find out the benefit of that overtime. A study conducted by salary calculator Income Tax UK has shown that while the UK lets Britons take home a significant amount of pay - it is beaten out by a number of other nations.

This is the same PAYE forecasting approach as used by HMRC by using the payroll period and the average rolling earning a projection of annual earnings is generated from which PAYE deductions are adjusted with a view to you having paid you complete income tax. Free tax code calculator Transfer unused allowance to your spouse. Check your tax code - you may be owed 1000s.

Loan pension contr etc Calculations verified by StriveX Accountants on 15 March 2021 at 1403. 125000 per annum then you are not granted Personal Allowance. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage.

Marriage tax allowance Reduce tax if you wearwore a uniform. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. You earned 18000 from rent.

The median monthly household income in the United Kingdom is 2491 before deductions such as income tax and National Insurance payments have been made. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. Once your Personal Allowance has been taken away the remaining amount will be taxed and your Personal Allowance will be left tax free.

You can also do salary calculations for every year since 2000. However if you earn over 125140 202021. 5 days ago Rental income tax calculator.

To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. Based on a 40 hours work-week your hourly rate will be 1923 with your 40000 salary. Why not find your dream salary too.

Hourly rates weekly pay and bonuses are also catered for. 2130 will be taxed at 40. The results are broken down into yearly monthly weekly daily and hourly wages.

Between 50271 and 150000 youll pay at 40 known as the higher rate and above 150000 youll pay 45 the additional rate. 2454 in rental income tax. This equates to an annual salary of 29900 annually although it should be noted that this figure represents the.

UK Monthly Income Tax Calculator. Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022. The calculator computes the monthly incomes to provide a forecast average from which PAYE is calculated based on a 12-month cycle.

On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate. Listentotaxman is the Original UK Income Tax Calculator. Unless you are earning over 125140 then your tax is calculated by simply taking your Personal Allowance amount away from your income.

How To Calculate Income Tax In Excel

In Hand Salary Calculator 2021 Pay Slips Monthly Tax India

Paycheck Calculator Take Home Pay Calculator

Comparison Of Uk And Usa Take Home The Salary Calculator

Ask Sage Income Tax Paye General Information And Manual Calculations

50 000 After Tax 2021 Income Tax Uk

How To Calculate Income Tax In Excel

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

How To Create An Income Tax Calculator In Excel Youtube

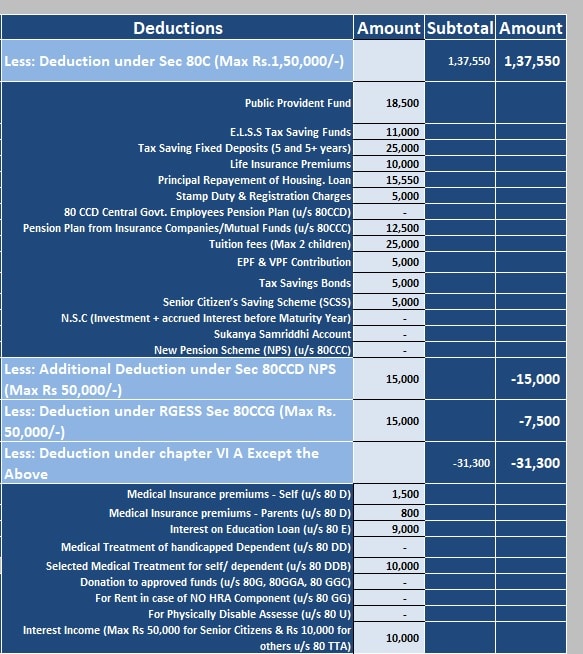

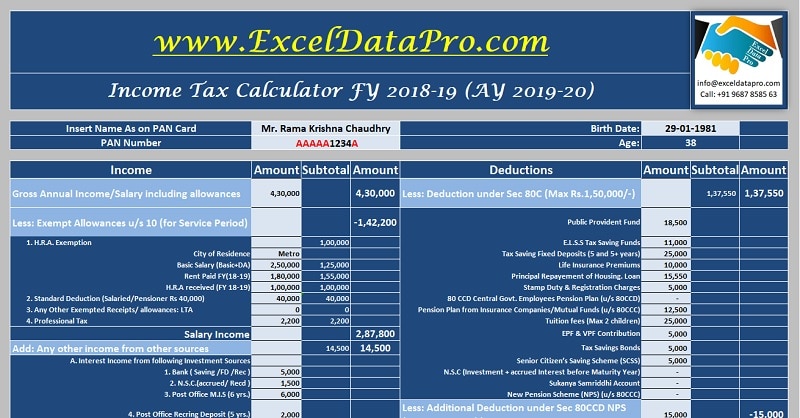

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

How To Calculate Income Tax In Excel

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

Comparison Of Uk And Usa Take Home The Salary Calculator

How To Calculate Income Tax In Excel

1 560 A Month After Tax Uk July 2021 Incomeaftertax Com

Calculating Your Tax With Self Employment Tax Calculator Is Safe Providing Details Is Just What People Need To Do Every Self Employment Employment Income Tax

How To Calculate Foreigner S Income Tax In China China Admissions

Ask Sage Income Tax Paye General Information And Manual Calculations

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Post a Comment for "Monthly Income Tax Calculator Uk"