Salary Meaning Under Income Tax Act

INCOME UNDER THE HEAD SALARY. Value of any perquisites.

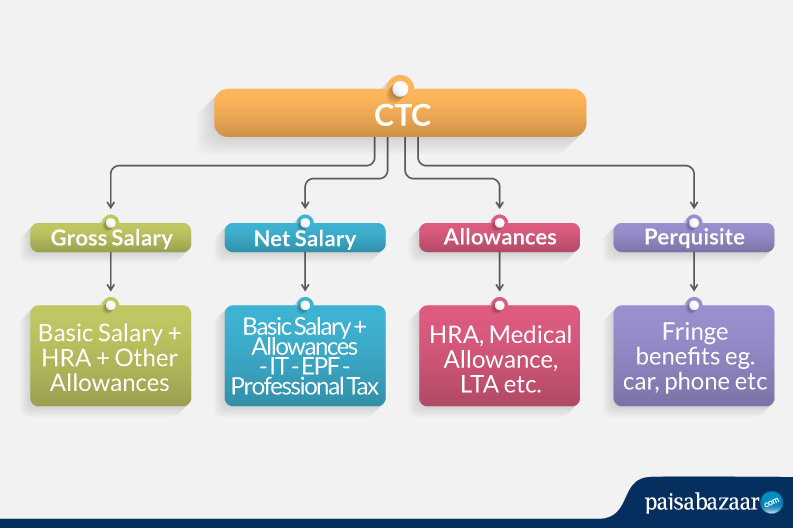

Salary Structure Components How To Calculate Take Home Salary

If any amount received from a former employer in relation to the services that you have rendered to him during your tenure of employment then the amount received will be taxable under the head salary.

Salary meaning under income tax act. You might be getting your income as salary for doing some job or as profits from your business or in any other manner. It includes monetary value of those benefits and facilities provided by the employer which are taxable. Ie apart from the items listed in the definition any receipt which satisfies the basic condition of being income is also to be treated as income and charged to income tax accordingly.

Amount contributed by the employer towards the recognized provident fund in excess of 12 of salary. The term salary for the purposes of Income-tax Act 1961 will include both monetary payments eg. THE DEFINITION OF SALARY.

But receipts for all kinds of services rendered cannot be taxed as salary. 51 Any person responsible for paying any income chargeable under the head Salaries shall at the time of payment deduct income-tax 6 on the amount payable at the average rate of income-tax 7 computed on the basis of the 8rates in force for the financial year in which the payment is made on the. Definition of Word Salary or Income by way of Salary Section 17 1 According to Section 17 1 salary includes the following amounts received by an employee from his employer during the previous year.

The existence of an employer-employee relationship is a must for a payment to be taxed under the head salaries. As per Indian Income Tax Act Salary includes-Wages. Meaning of salary.

D Value of perquisites specified in sub-section 2 of Section 17 of the Income Tax Act. Basic salary bonus commission allowances etc as well as non-monetary facilities eg. However leavetravel concessionnot included in salary will be classified as an expense for the purposes.

Income tax is defined as the tax levied on the annual income earned by a person. Income is anything and everything a person earns. The statute enjoins every employer to estimate the liability of tax deductible at source and to deduct tax at an average rate.

Housing accommodation medical facility interest free loans etc. Any remuneration paid by an employer to his employee in consideration of his service is called Salary. Section 15 as discussed earlier gives the scope of this head and tells us that which incomes shall form part of this headSection 16 gives deductions to be allowed out of incomes taxable under this head.

However income tax act 1961 defines the term salary us 17 1 to include the following monetary as well as non monetary payments -. 2 24 5 145 of IT Act 1961Income All receipts are not income. Within the meaning of salary.

Salary in simple words means remuneration of a person which he has received from his employer for rendering services to him. Salary in common parlance means any amount paid by an employer to his employees in lieu of services rendered by them. In the present case the dividends were received of shares which were held as investments.

A in relation to an employer being a company other than a banking company which has not made the arrangements prescribed under the Incometax Act for the declaration and payment within India of the dividends payable out of its profits in accordance with the provisions of section 194 of that Act sixtyseven per cent of the available surplus in an accounting year. Interest on balance in RPF in excess of specified limit. Section 15 16 and 17 of the Income tax act 1961 deal with the computation of income under the head Salaries.

It is therefore taxable in the hands of the employee subject to the exemption under clause 5 of section 10of theIncome-taxAct. 20 March 2008 The definition of income under the Income Tax Act is of an inclusive nature. Iii of clause 2 or proviso to clause 2 of Section 17.

Section 17 1 defined the term Salary. The amount of tax applicable to you will depend on how much money you earn as income over a financial year. Taxpayers can make their income tax payment TDSTCS payment and.

The employer must estimate this tax liability at the very beginning of the financial year in accordance with. Any gratuity over and above the exemption limit. The definition of Income as given in the Act us 2 24 is an inclusive definition.

The term salary under Income Tax Act has been defined to include all sums that an employee receives from his employer during his tenure of service. Only those receipts which are in the character of income can be assessed to tax. Computation of Salary Income Section 15-17 Salary income of an employee is to be computed in accordance with the provisions laid down in sections 15 16 and 17.

For this the employer is required to determine the salary payable to the employee and accordingly compute the tax liability.

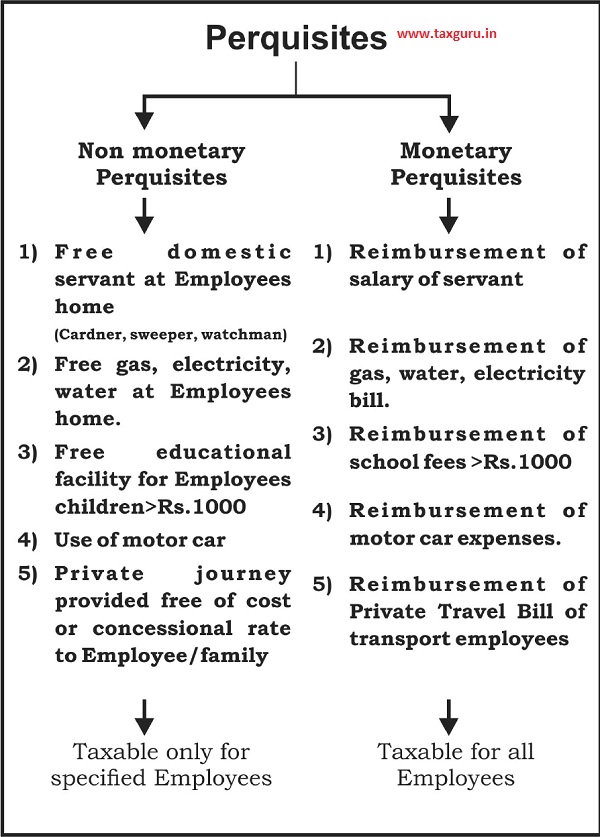

Definition Of Perquisites As Per Section 17 2

Perquisites Under Income Tax Act Taxability Indiafilings

Leave Salary Or Leave Encashment Section 10 10aa Taxability Of Re

Taxability Of Enhanced Gratuity Received After Retirement

Income Under The Head Salaries Ppt Video Online Download

French Minimum Wage And Average Salary In France Expatica

Taxability Of Salary Income Perquisites Allowances

![]()

Computation Of Income Under The Head Salary Hostbooks

Valuation Of Perquisites Of Salaried Taxpayer

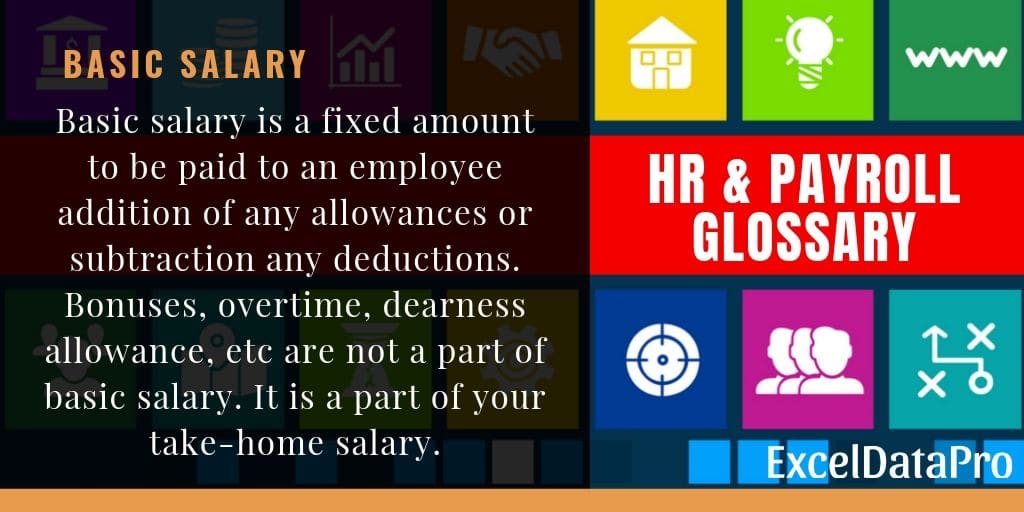

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Computation Of Gross Salary Income

Income Chargeable Under The Head Salaries

Income Tax It Returns Rules What Is Income Tax For Fy 2019 20

![]()

Computation Of Income Under The Head Salary Hostbooks

Income From Salary Calculation Allowances Perquisites

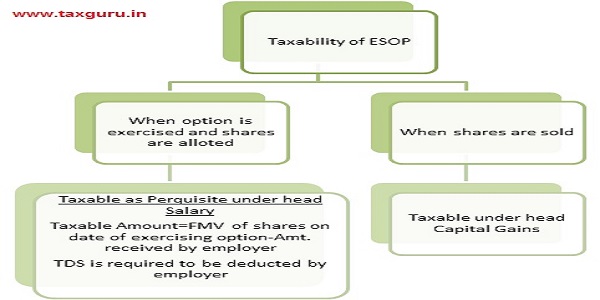

Taxability Of Esop Under Income Tax Act 1961

Computation Of Gross Salary Income

Section 192 Tds On Salary Computation Under Income Tax Act Tax2win

What Is Income Tax The Financial Express

Post a Comment for "Salary Meaning Under Income Tax Act"