Annual Income Plan Meaning

The definition of annual is yearly On a credit card application you report the amount of income you receive on a yearly basis. If you are an employee who works on a salary its easy.

4 Ways To Calculate Annual Salary Wikihow

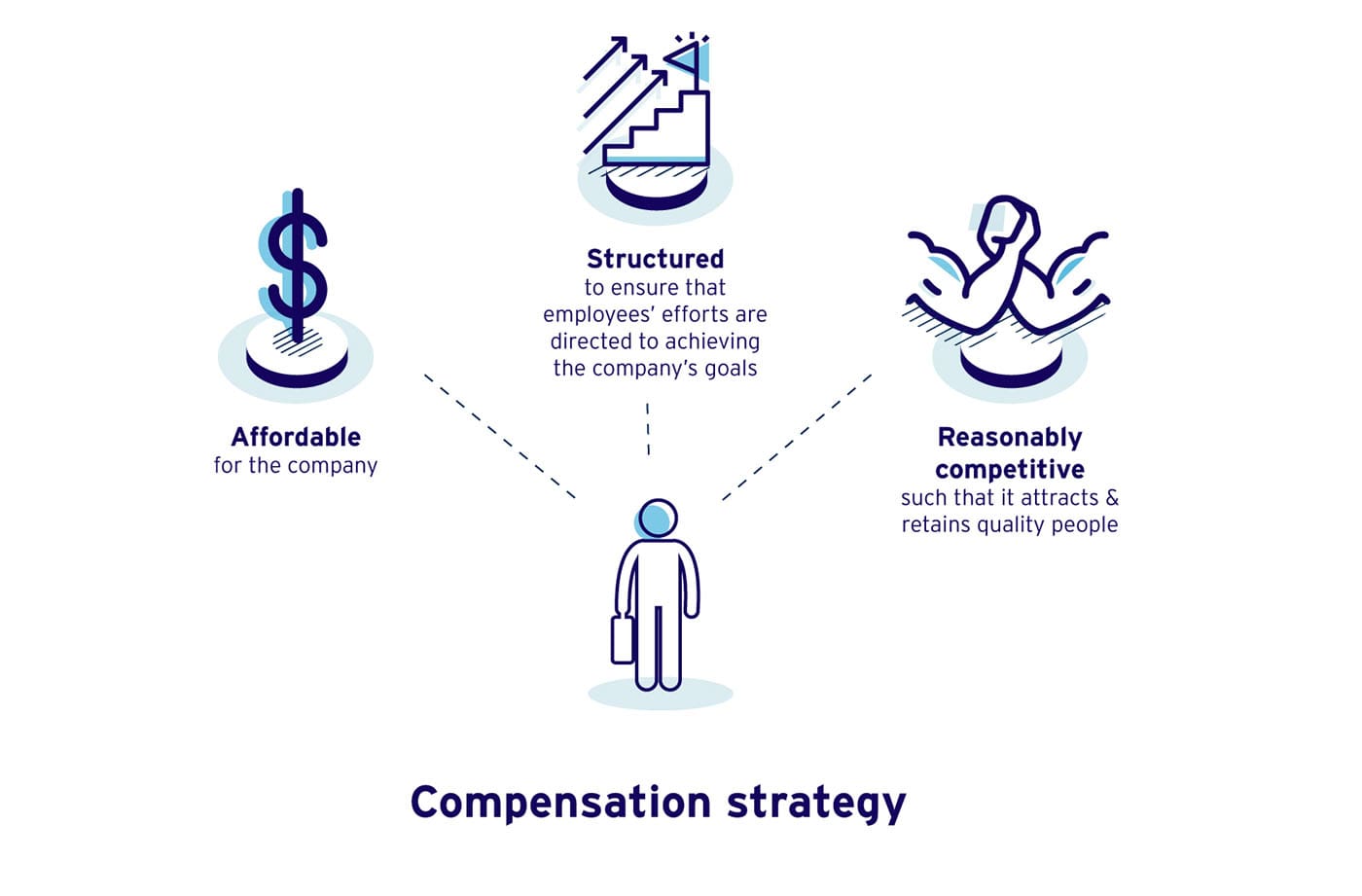

Short-term annual incentive plans are generally the second largest compensation vehicle for senior executives accounting for approximately 24 of compensation on average in 2017.

Annual income plan meaning. It is the sum of all income perceived by an individual in that 12-month period. Your annual net income can also be found listed at the bottom of your paycheck. Your registered retirement savings plan RRSP and pooled registered pension plan PRPP deduction limit often called your contribution room is.

A guaranteed basic income for all Canadians has emerged as the top policy choice of Liberal MPs just as the Trudeau government is crafting its plan. You can determine your annual net income after subtracting certain expenses from your gross income. To simply put it annual means year and income means money earned.

You deposit a lump sum of money and they agree to pay you a guaranteed income for a set period of time or for the rest of your life. Beginning in April 2020 and ending in September 2020 monthly GAINS payment amounts are automatically doubled. The amount that you can contribute to your RRSP PRPP in addition to your employers contributions or SPP.

An annuity is a contract with a life insurance company. The concept applies to both individuals and businesses in preparing annual tax returns. What Does Annual Income Mean.

Your average salary that is your salary during your five consecutive years of highest paid service. Annual net income is the amount of money you earn in a year after certain deductions have been removed from your gross income. A life income plan is a financial product for high-income professionals that ensures a lifetime guaranteed income for retired participants.

Annuities are most commonly used to generate retirement income. Responding to COVID-19 announced a temporary top-up to payments made through the Ontario Guaranteed Annual Income System GAINS. Retirement income from the public service pension plan.

The Liberal government could be taking a hard look at the possibility of a guaranteed annual income after it invited one of Canadas leading experts on the subject to speak at a pre-budget. Your annual lifetime pension is based on your average salary of your five consecutive years of. Once funded an income annuity is annuitized immediately although the.

Annual income refers to how much income a person earns in one year fiscal or calendar before deductions. 2 x years of service x average income for best five years pension benefit. Gross annual income refers to all earnings before any deductions are made and net annual income refers to the amount that remains after all deductions are made.

Generally the formula for calculating your pension is as follows. Annual income can be expressed as a gross figure or a net figure. Total amount of money earned in a calendar year before taxes.

The amount that you can contribute to your spouse or common-law partners RRSP or SPP. Mincome the Manitoba Basic Annual Income Experiment was a Canadian Guaranteed Annual Income GAI social experiment conducted in Manitoba in the 1970s. Depending on the data that is required to determine your annual income you may base your income on either a calendar year or a fiscal year.

A calendar year is January 1st to December 31st of the same year. Responding to COVID-19 announced a temporary top-up to payments made through the Ontario Guaranteed Annual Income System GAINS. The project was funded jointly by the Manitoba provincial government and the Canadian federal government under Prime Minister Pierre TrudeauIt was launched with a news release on February 22 1974 under the New Democratic Party.

Your annual lifetime pension payable from the public service pension plan is based on. It includes any salary you earned after completing 35 years of service if that salary is the highest. This action provides additional and immediate financial support to low-income Ontario seniors who may need more help to.

This income is determined by a formula which is usually based on years of service and earnings. You report the amount of salary you receive each year. AIPs generally payable in cash are designed to reward employees for annual performance relating to key operational and financial measures as well as individual performance and significant non-financial.

It is the gross cumulative amount earned by an individual in a span of twelve 12 months. An income annuity is an annuity contract that is designed to start paying income as soon as the policy is initiated. Receiving income is the goal of all commerce.

Annual income is usually taxed by the government though ones taxable income for a year may differ from hisher actual annual income. Ontario Guaranteed Annual Income System payments for seniors If youre a low-income senior you may qualify for monthly Guaranteed Annual Income System payments. One sample formula might be.

A defined benefit plan guarantees the employee a specific income at retirement. Annual Income The money a person makes from labor investment or any other source in the course of a year. The public service pension plan provides for the payment of a lifetime pension payable until your death and a temporary bridge benefit payable until age 65.

Annual income is the total income that you earn over one year.

Your Discretionary Income Student Loans How One Impacts The Other Student Loan Hero

Flat Tax Overview Examples How The Flat Tax System Works

Income Statement Definition Explanation And Examples

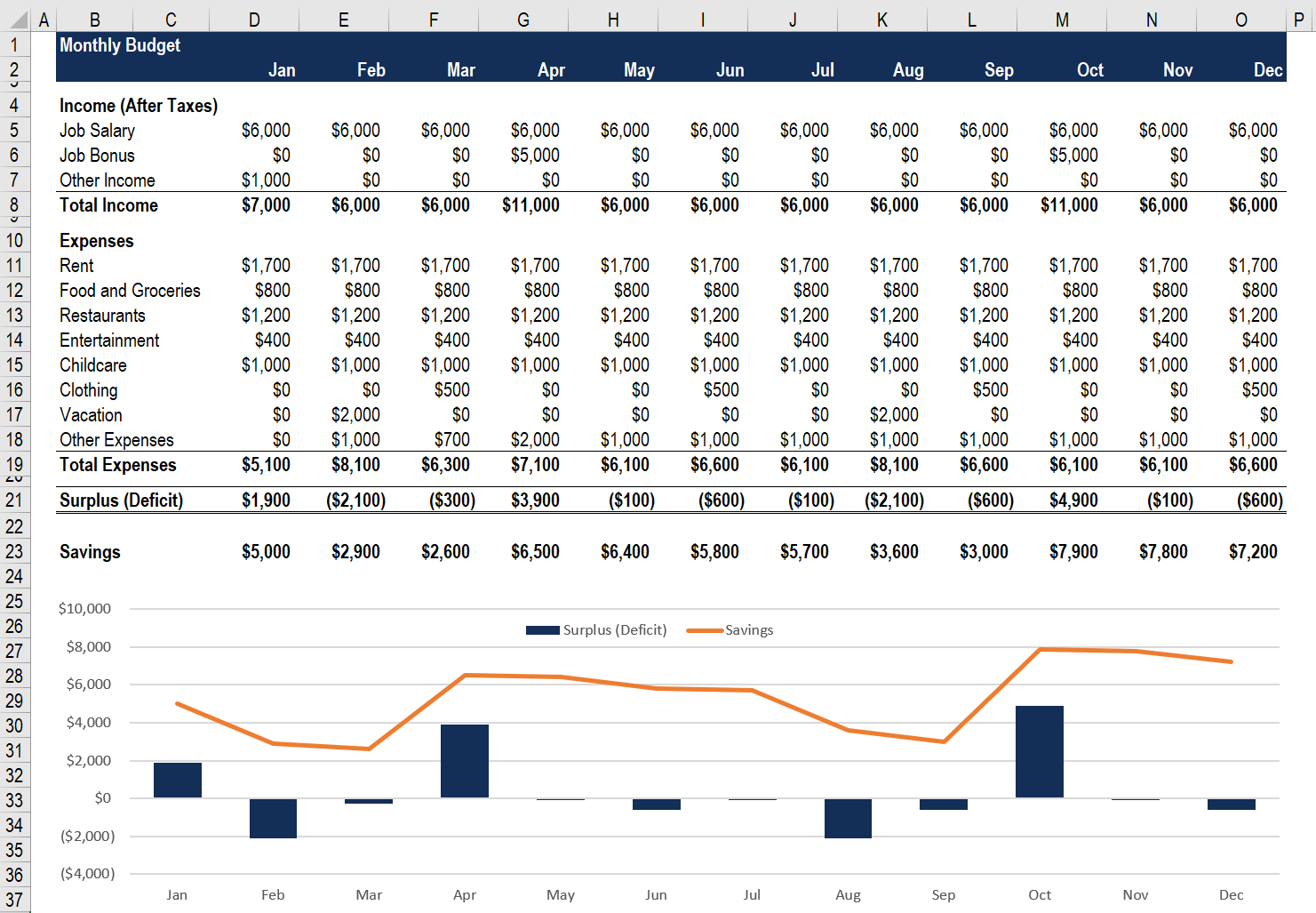

Budget Spreadsheet Definition How To Use And How To Create

Ranking The Best Passive Income Investments Financial Samurai

/GettyImages-538371567-e08df568b16a4ff1abbd4c28edba9d49.jpg)

Annual Compensation Vs Annual Salary

What Are The Different Types Of Compensation Payscale

Ranking The Best Passive Income Investments Financial Samurai

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Base Salary And Your Benefits Package Indeed Com

Income Statement Definition Explanation And Examples

Retirement Planning The Ultimate Guide For 2021

Evaluating Executive Compensation

Employee Compensation Salary Wages Incentives Commissions Entrepreneur S Toolkit

Understanding Your Pay Statement Office Of Human Resources

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Employee Compensation Salary Wages Incentives Commissions Entrepreneur S Toolkit

/32472099753_4ff632c47a_o-b4c2e90712494b0bb08b27cc9652ce30.jpg)

Post a Comment for "Annual Income Plan Meaning"