Monthly Payroll Calculator Ontario

Your average tax rate is 220 and your marginal tax rate is 353This marginal tax rate means that your immediate additional income will be taxed at this rate. The amount can be hourly daily weekly monthly or even annual earnings.

Employment income This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services Self-employment income This is income from a.

Monthly payroll calculator ontario. Please select a province to access specific 2021 salary calculators including Provincial and Federal tax calculations for the 202122 Tax Year. It will confirm the deductions you include on your official statement of earnings. You assume the risks associated with using this calculator.

Gross annual income - Taxes - Surtax - CPP - EI Net annual salary Net annual salary Weeks of work year Net weekly income. The online calculator makes it easier to calculate payroll deductions. The calculator is updated with the tax rates of all Canadian provinces and territories.

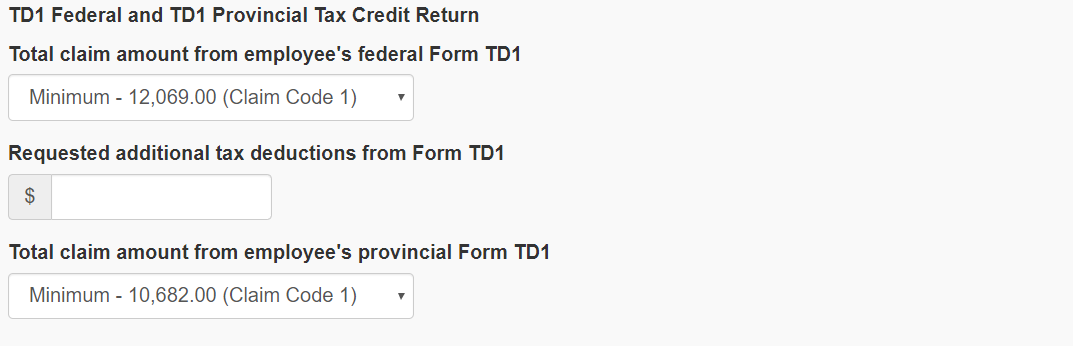

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Employment Standards Information Centre. Use the simple monthly Canada tax calculator or switch to the advanced Canada monthly tax calculator to review NIS payments and income tax deductions for 2021.

This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. Get accurate payroll calculations every pay run automatically with QuickBooks Online plus Payroll. PDOC calculates payroll deductions for the most common pay periods as well as the applicable province except Quebec or territory.

Each salary calculator provides detailed tax and payroll deductins to allow visability of how salaries are calculated in each province in Canada in 2021 based on the. Newfoundland Prince Edward Island Nova Scotia New Brunswick Quebec Ontario Manitoba Saskatchewan Alberta British Columbia Northwest Territories Nunavut Yukon. May 30 to Jun 5.

Ontario Mortgage Calculator Our mortgage calculator contains Ontario current mortgage rates so you can determine your monthly payments. Trusted by thousands of businesses PaymentEvolution is Canadas largest and most loved cloud payroll and payments service. Income Tax Calculator Ontario 2020.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Calculate CPP EI Federal Tax Provincial Tax and other CRA deductions. The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month.

For your 2021 payroll deductions you can use our Payroll Deductions Online Calculator PDOC. PDOC is available at canadacapdoc. Were bringing innovation and simplicity back into the Canadian payroll market from new ways to pay your employees to our open.

Generally most people think of a month as having 4 weeks. The employee I was paid vacation pay during the four work weeks before the public holiday Enter any vacation pay paid or received in the 4 weeks before the public holiday. This may include paid vacation time or 4 vacation pay or more on every cheque or vacation pay in either a portion or a lump sum.

You can use the calculator to compare your salaries between 2017 2018 2019 and 2020. Newfoundland Prince Edward Island Nova Scotia New Brunswick Quebec Ontario Manitoba Saskatchewan Alberta British Columbia Northwest Territories Nunavut Yukon. Personal Income Tax Calculator - 2021 Select Province.

Accountants bookkeepers and financial institutions in Canada rely on us for payroll expertise and payroll services for their clientele. So to be more accurate we use 4333 weeks per month. Simplepay includes Direct Deposit Electronic Remittances Statutory Holiday Calculator Timesheets Custom Earning Deductions General Ledger Import All CRA forms T4T4ARL1ROE.

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2020 income tax refund. Usage of the Payroll Calculator. You can calculate your Monthly take home pay based of your Monthly gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables.

But 4 weeks multiplied by 12 months 48 weeks vs. Payroll calculator Use this free calculator to estimate gross pay deductions and net pay for your employeesor yourself. Canada Salary Calculators 202122.

Our calculator also includes mortgage default insurance CMHC insurance land transfer tax and property taxes. Personal Income Tax Calculator - 2020 Select Province. This places Canada on the 12th place in the International Labour Organisation statistics for 2012 after France but before Germany.

All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. 416-326-7160 Greater Toronto Area 1-800-531-5551 toll free Canada-wide 1-866-567-8893 TTY for hearing impaired. Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques.

Formula for calculating net salary The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. The unadjusted results ignore the holidays and paid vacation days. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432That means that your net pay will be 40568 per year or 3381 per month.

There are 12 months and 52 weeks in a year. Enter your pay rate.

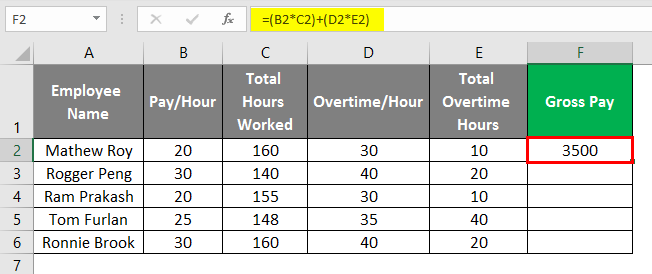

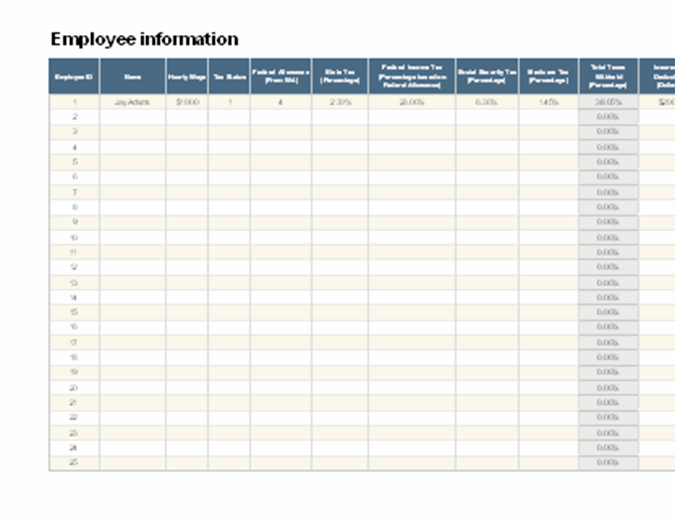

Payroll In Excel How To Create Payroll In Excel With Steps

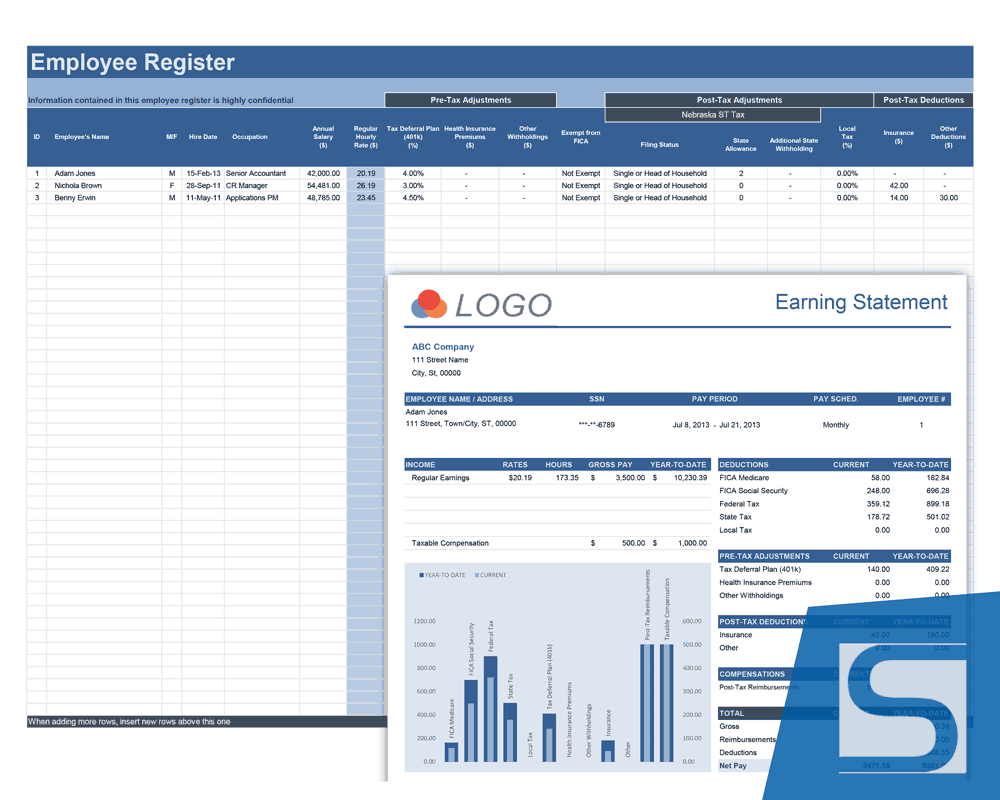

Payroll Calculator With Pay Stubs For Excel

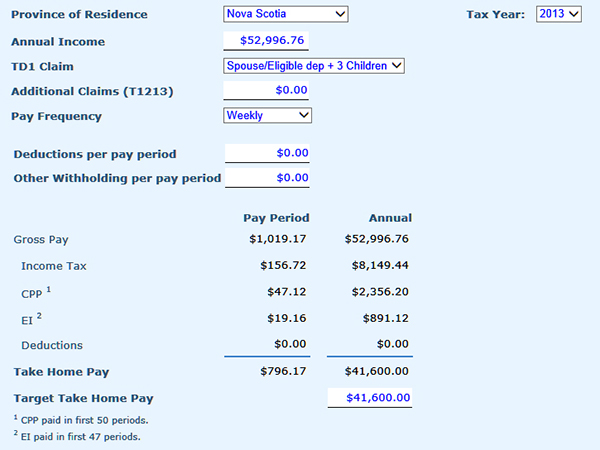

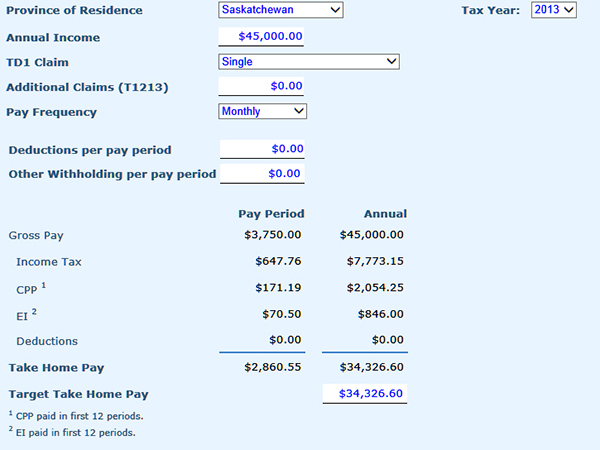

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Tax Deductions Monster Ca

Calculate If That New Job Is Right For You Knowledge Bureau

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Free Employee Payroll Template For Excel

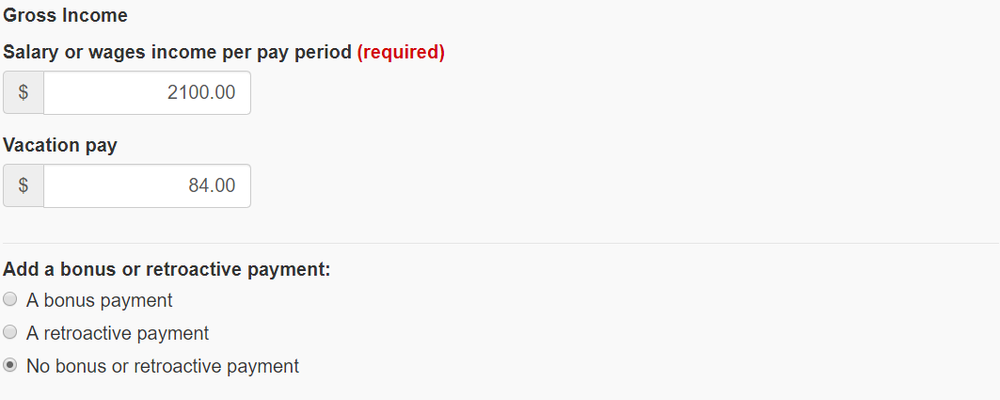

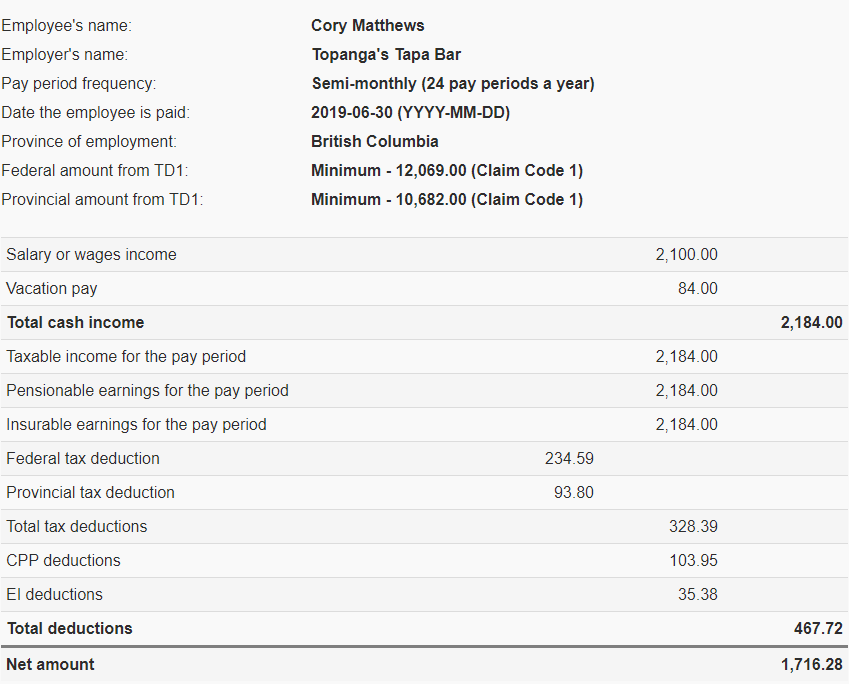

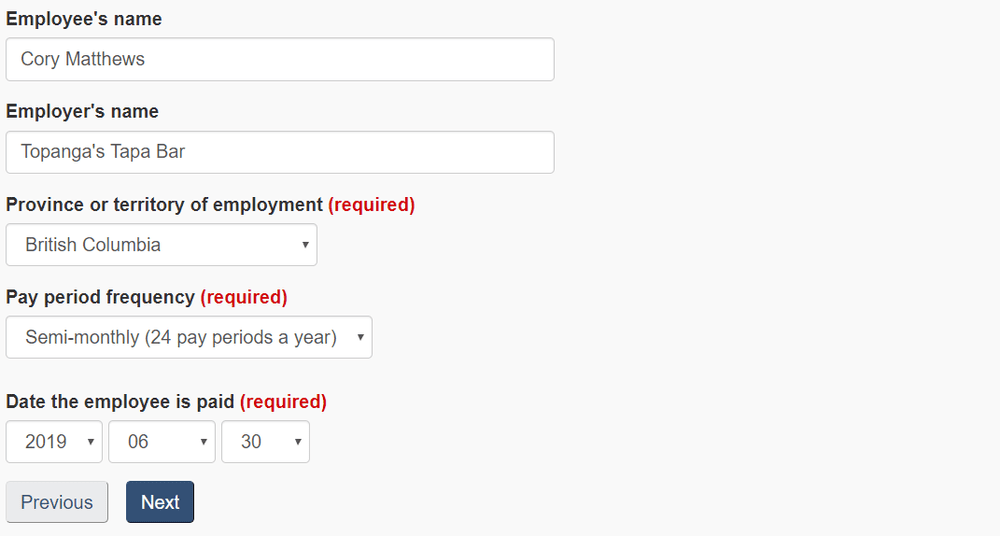

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Calculate If That New Job Is Right For You Knowledge Bureau

Payroll Calculator With Pay Stubs For Excel

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Salary Calculation Sheet Template As The Name Indicates Is A Spreadsheet That Helps Calculate Each Employee Payroll Template Spreadsheet Design Excel Budget

How To Calculate Your Monthly Car Payments

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Mathematics For Work And Everyday Life

Paycheck Calculator Take Home Pay Calculator

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Payroll Calculator Free Employee Payroll Template For Excel

Post a Comment for "Monthly Payroll Calculator Ontario"